What if you could create recurring, consistent income that

afforded you the lifestyle you’ve always imagined

yourself having?

Right now, there are THOUSANDS of investment opportunities that will create income for you to take into your retirement. Opportunities that, when used correctly, have created more wealth and financial security than any other avenue.

How Commercial Real Estate Can Fund Your Retirement

... even if you’ve never invested in real estate before.

In this zero upsell, no fluff course, I’m showing you exactly How to create your own Commercial Real Estate Empire (like some of the wealthiest people in America have)... without second-guessing, losing your shirt or giving up before you even start.

-

“Conrad Hilton” invested wisely in real estate in the 1930s - and amassed a fortune that allows his descendents to do virtually whatever they want.

-

“Donald Trump” before he became the one person who can easily polarize a nation, put his name on the sides of some of the tallest buildings in the country.

-

“John Jacob Aster” was the first millionaire in America... and he was a real estate investor.

These three men and the countless more like them are living proof that real estate investments - when made wisely and as a business decision - pay off. And pay off big.

So the Question is :

Are you using real estate investments in your portfolio?

If you’re like most of the people that visit this page, you’ve toyed with the idea of purchasing an “investment home,” a single-family property or townhome with the idea of flipping or renting.

But the world of real estate investing goes much deeper than that - in fact,

I’ve personally

identified at least 17 niches that you could explore

that carry different levels of risk,

investment capital, and management time.

17 different niches that can pay off handsomely if you invest in them properly.

17 different ways for you to create the retirement income you need to finance the life you want to live.

The thing about real estate that makes it so successful: land is a finite resource. There is only so much room for new houses, new office complexes, new advertising space. Which means the value of existing properties (and the space on which to develop new ones) will continue to increase in value as the resource is depleted.

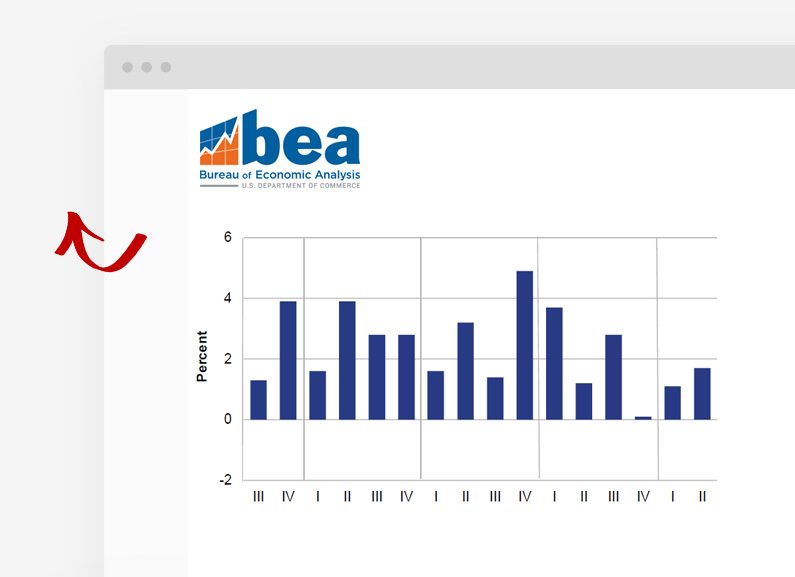

According to a Stateline analysis of inflation-adjusted data from the U.S. Bureau of Economic Analysis, the construction industry’s impact on U.S. gross domestic product has grown by more than 21 percent since its recession low point in 2011, and in 2016, construction’s contribution to the U.S. economy soared above $650 billion for the first time since 2008.

The thing about real estate that makes it so successful: land is a finite resource. There is only so much room for new houses, new office complexes, new advertising space. Which means the value of existing properties (and the space on which to develop new ones) will continue to increase in value as the resource is depleted.

According to a Stateline analysis of inflation-adjusted data from the U.S. Bureau of Economic Analysis, the construction industry’s impact on U.S. gross domestic product has grown by more than 21 percent since its recession low point in 2011, and in 2016, construction’s contribution to the U.S. economy soared above $650 billion for the first time since 2008.

That means real estate is HOT.

Now the question becomes:

WHICH real estate investments will have the biggest impact on your retirement?

To help you answer this question, I’ve created a resource to show you exactly how to find, purchase, and profit from the real estate investment options available to you RIGHT NOW.

But before I tell you about that, let me show you why I’m the right person to share this information with you.

My name is Frank Rolfe and I’ve been a commercial real estate investor for nearly 30 years. My personal real estate portfolio is nearly $1 Billion of self-storage facilities, mobile home parks (5th largest owner in the U.S.), RV Parks, billboards (formerly the largest private owner in Dallas/Ft Worth), apartments, and single family residences, throughout the U.S.

Frank Rolfe

Real Estate Investor

One of the smartest men I know, Dave Reynolds, who has been an active real estate investor for over 25 years. Together, he and I are the 5th largest owner of Mobile Home Parks & RV Parks in the country, and Dave is well known for his ownership of some of the highest-traffic real estate websites in the US - which total over 100k page views per day

Dave Reynolds

Real Estate Investor

Plainly put: Dave and I know our stuff when it comes to making money with real estate.

We decided that because of our success in Real Estate, we were the right people to put together a comprehensive course to help people just like you figure out how to use real estate to fund their retirements

After all, our retirements and our families are already taken care of.

What about yours?

That’s where The Commercial Real Estate

Home Study Course comes in.

The Commercial Real Estate Home Study Course is designed to hand you everything you need to know in order to get started in Commercial Real Estate investing - even if you’ve never invested before.

Here’s what we came up with:

First, we’re going to give you the crash-course overview of real estate investing. In this 69 page manual, we’re covering every single concept you need to understand to be successful with your investments, as well as our own personal advice on the matter.

You’ll Discover:

- How to find a property to buy - including our favorite 7 strategies for finding hot properties FAST...

- How to evaluate a property’s value... like what CAP rate is and why it’s important to know and how you could easily lose money on a deal (avoid this one thing and your risk goes WAY down)...

- How to successfully negotiate a deal from the buyer’s side (plus our strategy for successful negotiations that most investors forget to do)...

- How to save a deal when things go wrong (and how to know when even re-negotiating won’t work)...

- How to finance your investments - the 4 types of financing you can pursue and how to use each one to your advantage...

- The 11 things to be aware of in every loan so you’re making the best decisions for your business...

- Why building a budget REALLY matters (and how to use it to give you valuable insight into your business’s health)...

- What turnaround is (and why you may need to know it to be successful)... as well as the 6basic parts of a turnaround and how to maximize your revenue while minimizing expenses...

- How to operate a property successfully if you decide to create consistent cash flow rather than “flipping” style pay-days...

- How to sell your property for maximum gain... with a crash course in negotiating from the OTHER side of the table!

The information contained in this one manual is what Dave and I have spent our entire lives learning. And believe me, when you learn these things the hard way... it can get expensive.

But

we wanted you to have this information UP FRONT so that you can go into each

new deal with your eyes wide open and your best foot forward.

But we’re not done yet.

The most important part of any deal is the due diligence that you do BEFORE you get to the closing table.

I cannot stress this enough. Doing your due diligence is the difference between making money (and retiring easy!) and losing money and swearing off real estate investment for good.

That’s why we’ve put together our 218 page 30 Days to Due Diligence Manual - an easy-to-follow process that will allow you to get all the information you need in just 30 days.

In this manual, we take you through doing your due diligence in one single month. Each day you will complete between 1-6 tasks, which makes your due diligence easier to manage because it’s broken down into chunks.

For instance, Day 1’s to-do list is:

- Get the Title Company Going on a Title Commitment

- Quick Audit of the Income

- Review the Rent Roll

- Dig into the Expenses

- Review the Seller’s Bank Deposits and Tax Returns

- Get any other needed Documentation from Seller

And of course we’re going to explain each step, give you whatever formulas or scripts or information you need, and make sure you fully understand what it is you need to do to besuccessful.

This has been developed from our combined 54+ years of performing due diligence on (nearly!) every property we’ve purchased... and when we didn’t follow this process before settling, we either lost money or got very, very lucky.

Plainly put: If you fill out the forms and follow the checklist for every deal you do - you will have more than enough information to help you make the right decision and fully understand the deal you’re getting into.

Here’s the thing: most of what can cause you to lose money on a deal can be found out in this 30-day Due Diligence period. And when you have this information, you’re able to make better decisions, negotiate better deals, and choose more wisely than if you don’t have it.

We will ALWAYS err on the side of caution when it comes to investment. That’s how we’ve managed to make our (not-so) small fortunes and finance our retirements. That’s how we give our families the lives we want them to have with our businesses.

That’s why we’ve included such a resource in

The Commercial Real Estate Home Study Course

Now, we understand that when you’re new to Commercial Real Estate investing, it can be tough to understand all the terms and meanings.

And frankly, if you don’t understand what the vendors, sellers, loan officers and others around you are saying... you’re at a disadvantage. That’s why we’ve created our 95-page Dictionary of Terms. This is the reference you can take with you as you learn the business, understand what’s being said, and never feel in the dark about what other people are talking about!

As you can see, this is not just some information that we’ve thrown together and presented as the A-Z guide. This is the definitive guide on the market to getting started in Commercial Real Estate.

Between these three manuals, there are 383 pages of information,

checklists, samples, scripts, examples, formulas, cheat sheets, plans and

resources for you to use in your business.

What you won’t find is any sales material for any other courses.

The Commercial Real Estate Home Study Course is NOT designed to upsell you into anything else, unlike most of the other stuff out there on the market. We didn’t leave out any crucial information in hopes that you’ll give us more money later.

In fact, I’m so sure you’re going to find immense value in this that I guarantee it for a full 90-Days with my 100% Any-Reason Money Back Guarantee:

Now, I could easily charge thousands of dollars for this information.

After all, think about what it will do for your income or for your retirement when you’re running a successful real estate investment business (or two, or three, or more...)

Imagine what your life will be like when you get to think about retirement without feeling drained or anxious or worried. Imagine retiring early because you’ve got the income to travel like you’ve always wanted.

I want that for you.

And so because of that, I’m including two SUCCESS BOOSTER Bonuses to help you be

even more successful.

SUCCESS BOOSTER Bonus #1: Audio & Video Learning Modules

I’ve put together 14 learning modules in which I explain everything in detail - from CAP rate to Location Growth (and that’s just in Module #1!)

These modules will help you not only understand more about what’s in the manual, but interact with the information in a different way. You can read the manual while you watch the video, or take the audios in your car on your commute.

These modules could easily be sold alongside the manuals as part of a live, intensive training that retails for nearly $2,000.00.

But you’ll get these modules FREE when you invest in The Commercial

Real Estate Home Study Course at just $597.

SUCCESS BOOSTER Bonus #2: Commercial Real Estate Investing File Library

Even though I’m giving you samples and checklists and resources throughout the 383 pages of manuals that I’ve already told you about... I’m also going to give you some separate, editable files that you can use to prep your deals and run your business.

You'll Receive:

- Commercial Property Evaluator (Automated Excel Worksheet)

- Commercial Real Estate Diligence Day by Day Costs (Excel Worksheet)

- Commercial Due Diligence Worksheet (Excel Worksheet)

- Commercial Real Estate Purchase Contract (Word Document)

Whenever you need to use one of these, simply open it on your computer and it’s 100% customizable.

If you were to just have the contract prepared by an attorney, it could easily cost you $500.00 to $1,000.00 in attorney’s fees.

But all 4 documents are yours for FREE with The Commercial

Real Estate Home Study Course

Earlier I said that I could charge thousands for this information, but the truth is that I’m not going to do that. And here’s why:

I fully believe that entrepreneurs and business owners are the backbone of the American economy.

Whether you invest in just one piece of real estate or it’s the stepping stone to a booming

real estate empire, it’s people just like you that are keeping communities running

by creating jobs and wealth.

And if I can do my part by putting this information in your hands, then I owe it to myself to make it affordable for you to do so. (But I can’t give it away, because then everyone would have access to it and that would create unfair competition.)

That’s why the investment for CRE University, including:

- The 69-Page Overview Manual

- The 218 Page Due Diligence Manual

- The 95 Page Commercial Real Estate Dictionary of Terms

- The 14 Audio & Video Modules

- The Commercial Real Estate File Library

Look, right now you have a couple options:

I’m not promising it will be easy. If it was, everyone and their brother would invest in real estate. But with knowledge and ambition on your side, you can create the kind of lifestyle you want.

I know from personal experience that Commercial Real Estate Investing is not only rewarding - it’s fun! You have the opportunity to find, groom, and secure the deals that nobody else has the knowledge or the gumption to reach for.

Isn’t that worth just $597?

Are you ready to finally take the rest of your life by the horns and build something for yourself.

Just click the big orange button below, fill out your information, and you’ll be immediately taken to the download area where you can get your resources.

Don’t wait and spend one more minute wondering what your future will look like.

Reach out and take it. Dedicated to your success,

Frank Rolfe

P.S. Not only will you receive an instant download of all the materials, I’m going to ship hard copies to your house so you can have them in your hands. The hard-copy manuals, the CDs, and the DVDs will be delivered right to your lap.

You’ll be building your business from the comfort of your very own home in no time!

P.P.S. If you don’t want to miss out on the chance to create a business that has your money working FOR you (instead of wasting away in some bank account or flying into the stock-market abyss)...

Click the button below now!